Where Have All of the Creditors Gone?

A Look at the Court Services Annual Report 2022

The Courts Service recently published its Annual Report for 2022. What did it say about the first year of normal court business following the COVID-19 pandemic? Head of Debt Recovery, Jason Harte analyses the numbers and trends in this report.

Speaking at the recent launch of the Courts Service Annual Report 2022, both the Minister for Justice, Helen McEntee and the Chief Justice, Donal O’Donnell made references to the modernisation programme ongoing in the Courts Service. Both noted that changes that came into effect during the pandemic, such as better usage of digital technology and remote hearings in some instances, were here to stay. However, despite undoubted modernisation of some aspects of the Irish collection litigation and enforcement systems, creditors are not returning to those systems in the same volume to collect money owed to them.

Keeping it local

The Report noted that there was a marked (39%) increase generally in civil cases coming before the District Court, between 2022 and the previous year. This is reflective of a broader trend that we had described over the past number of years, even before the pandemic. In terms of the issuing of new actions to recover debt in the District Court in 2022, the Report noted just over 15,000 new claims. This is a significant increase on the 12,405 issued in 2021. However, that 2022 figure still represented a 36% decrease on the pre-pandemic 2019 equivalent.

Default judgments

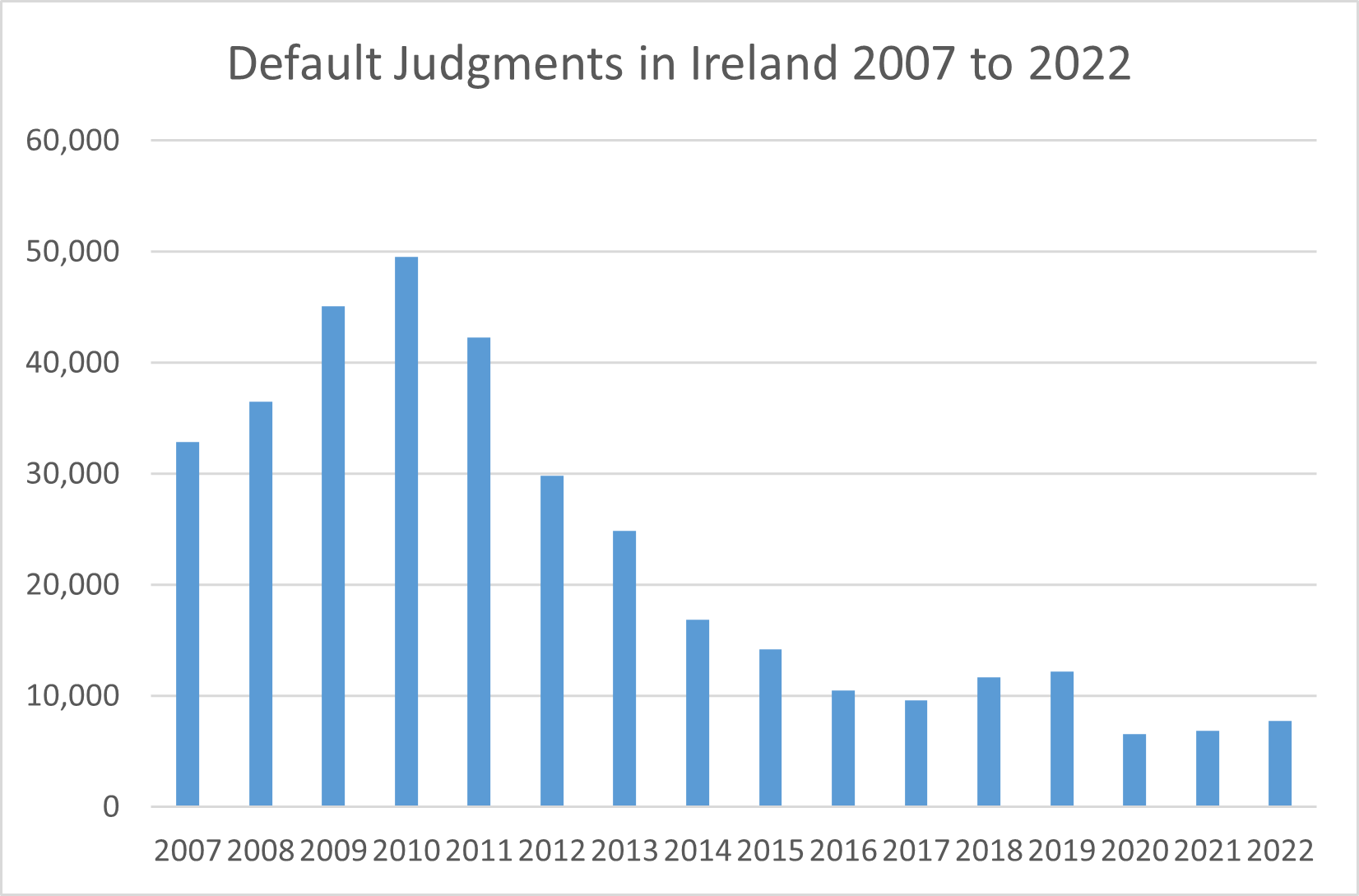

We have traditionally tracked collection and enforcement activity in the courts by looking at volumes of monetary judgments obtained against debtors, in default of appearance or of defence. We had previously noted that these had fallen dramatically from a peak back in 2010. However, there was a small 12% increase in the number of these judgments in 2022 compared to 2021. Again though, most of this increase was accounted for by a rise in default judgments in the District Court. The numbers stayed static across the Circuit and High Courts.

Enforcement options after judgment

Despite the post-COVID re-opening of the economy in 2022, this trend of creditors declining to use the legal system to enforce their rights is also reflected across the figures set out in the Report. For example:

- In 2022, creditors took steps to publish some 1,257 judgments in the Central Office of the High Court, compared to 1,414 in 2021, an 11% decrease

- 2022 saw the commencement of just 1,094 new Installment Order cases, down on the 1,243 in 2021

- The volume of judgment mortgages registered fell by almost 7% in 2022 compared to the previous year

- The numbers of bankruptcy summonses and bankruptcy petitions issued by creditors in 2022 were marginally down at 49 compared to 55 in 2021

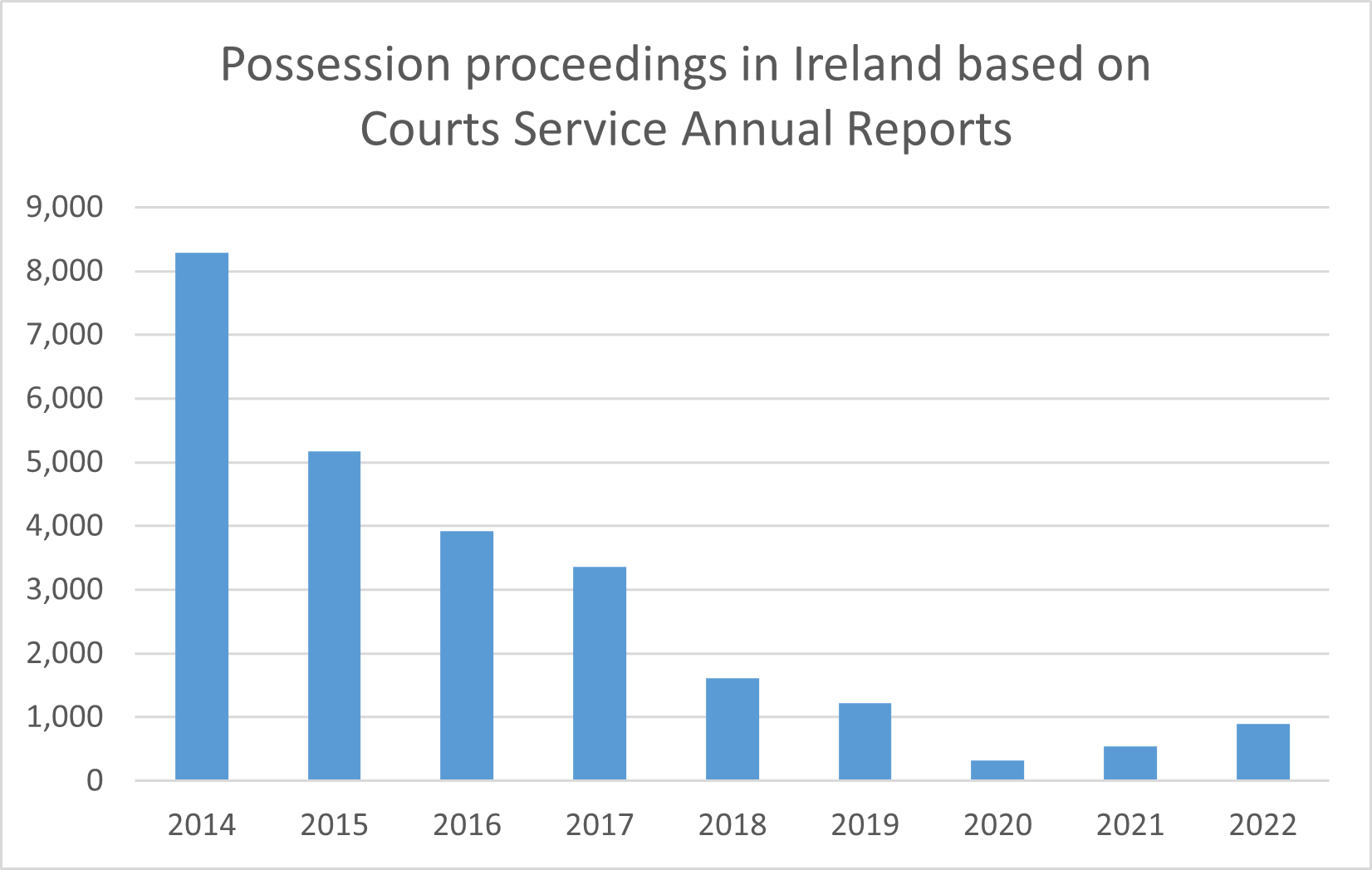

Possession litigation

In previous commentary on the Courts Service Annual Reports relating to the pandemic years, we highlighted that repossession litigation actually declined in that time. As 2022 also marked the end of exceptionally low interest rates, it suggested that legal proceedings issued by lenders to repossess secured properties on foot of the lender’s rights in a mortgage/charge document would rise. The Report indicates that these type of new proceedings rose somewhat in 2022, to 898. However, this is still a long way from the 2014 equivalent which as can be seen below, was almost ten times that.

Conclusion

The sentiments of the Chief Justice and the Minister regarding modernisation will resonate with creditors. Many creditors comment that the Irish legal system is not effective enough in assisting them recover undisputed debt. Delays in the system are frequently cited by business clients in particular as being the reason they simply write off bad or doubtful debt, rather than pursue it legally. Creditors will welcome the programme of modernisation, especially the digitisation of documents, if it cuts the time from a claim issue to judgment and if it goes towards streamlining enforcement.

Despite Ireland’s emergence from the pandemic restrictions in early 2022, the Report indicates that that year did not see any significant resumption of creditor litigation and enforcement. In previous articles, we have suggested that there is a natural time lag, circa 1- 2 years, from a change in the country’s economic cycle being reflected in the collection litigation and enforcement figures in the Irish Courts. 2023 has seen a rise in corporate insolvencies and it is inevitable that creditor enforcement will rise – albeit from a very low base.

The fact is that in a deteriorating economic environment, highlighted by the interest rate rises over the last year and constant spectre of inflation, creditors should not hesitate to enforce their rights in appropriate cases where the debtor can pay but is choosing not to.

For more information and expert advice, contact a member of our Debt Recovery team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

Share this: