Land Value Sharing and Urban Development Zones

Will they increase housing and infrastructure?

Two key Government initiatives, Land Value Sharing and Urban Development Zones, could have significant implications for landowners and developers. Introduced as part of the “Housing for All - a New Housing Plan for Ireland”, they are in the Government’s Autumn’s legislation programme. What are the likely implications of this proposed new legislation?

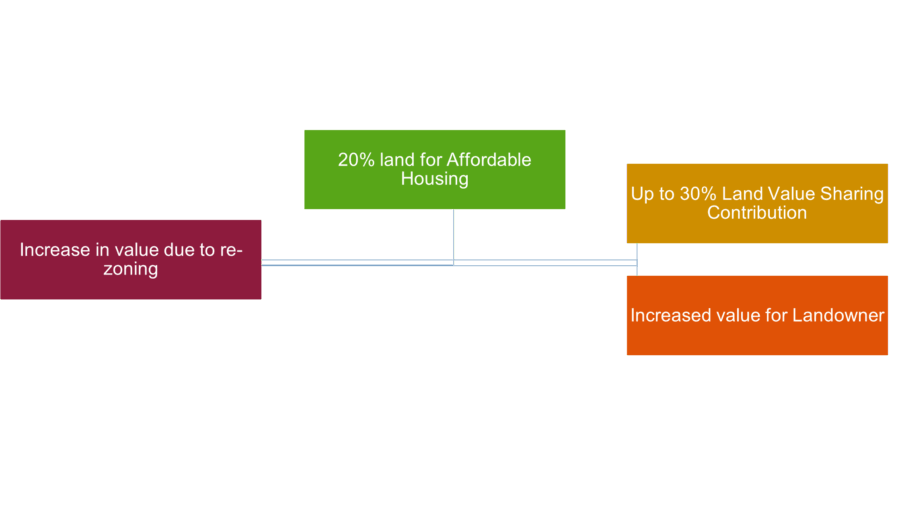

A General Scheme agreed in December 2021 provides an indication. Broadly speaking, Land Value Sharing means sharing up to 30% in the increase in the value of land which has been zoned residential or mixed-use including residential. Landowners will pay this sum as a condition of the grant of planning permission, with the levy to be used by the local authority for the provision of public services.

The second initiative is the empowerment of the Government to designate certain urban areas as Urban Development Zones. Once designated, a planning and delivery scheme can be adopted for the area. Significantly, the designation restricts what landowners can do with their land within these zones with the intention that the land is assembled for, and developed in accordance with, the planning and delivery scheme.

Sharing of land value increases

Where land is zoned for residential use after the coming into effect of the legislation, any planning permission for that land can include a condition for the applicant to pay a “land value sharing contribution”. This contribution will be a percentage of the increase in value of the land as a result of the rezoning. The Government has not prescribed the percentage figure but noted it is likely to be up to 30%.

An Explanatory Note to the Bill explains that this limit was chosen so that, when added to the 20% Part V affordable housing requirement, the overall impact of the two schemes will result in the sharing of a maximum of 50% of the uplift in value. However, in our view this has conflated different mechanisms. The 20% requirement under Part V is based on a proportion of the land/newly constructed units and is not calculated on the basis of an increase in market value.

The local authority must use the contribution towards public infrastructure in the vicinity of the developer’s planning application. The Government proposes to broaden the range of “public infrastructure” that can be funded from those under current legislation including, for example, recreational and community facilities. The set contribution percentage does not appear to be linked to any specific calculation of local infrastructure requirements in the relevant area. There also doesn’t appear to be a requirement for the local authority to return surplus contributions.

A potential issue with the current drafting of the General Scheme appears to be the valuation methodology. It proposes to follow the same process as that for the vacant site levy. However, this is subject to change. It is unclear whether it will account for any increase in the value of land that is not a result of the rezoning, such as the general rate of inflation of land prices, as well as other improvements in the area such as increased public transport and infrastructure. This may be an attempt to encourage landowners to apply for planning permission promptly once the land has been re-zoned.

Urban Development Zones

Planning authorities, or certain development agencies, with the planning authority’s consent, may apply to designate an area as an Urban Development Zone. In order to be so designated, the land must be:

- Urban

- Under-utilised, and

- Have the potential to be of significant economic, social or environmental benefit to the State if developed

The application must contain set requirements and undergo public consultation.

The implications of land being designated an Urban Development Zone include:

- The land cannot be rezoned

- Planning permission may be refused for certain developments within the designated area, without the need for compensation

- Planning permission extensions may be refused

- The relevant planning authority may be empowered to vary any existing planning permissions restricting the time period for such permissions to a maximum of 24 months

- The planning authority shall carry out a valuation of all parcels of land as they were before the designation, to be confirmed by the planning authority within 6 months of the designation, with the owner having a right to appeal to the Tribunal

- The planning authority may use the existing compulsory purchase mechanism to acquire land in the designated area, or may enter into agreements with the owner for the transfer of land

- Where an owner of land in an Urban Development Zone wishes to sell the land, they must first offer it to the local authority/development agency

- Any planning permission granted in an Urban Development Zone may include a Land Value Sharing planning condition, and

- The planning authority may designate areas of “critical land” for infrastructure, which places further restrictions on this land

Within 1 year of the designation of the land, the planning authority must prepare a draft planning and delivery scheme setting out the development plan for the area and public facilities to be provided. Once adopted, there will be a fast-track planning process if the intended development is in accordance with the scheme. Landowners and developers of land within a proposed UDZ should engage with the public consultation exercise to ensure its development aims are aligned with those of the planning authority.

Key Takeaways

The Government intends for the land-value sharing contributions to provide more certainty to landowners and developers on the requirement to contribute to public infrastructure. However, the fixed percentage does not appear to relate to the estimated costs for the infrastructure required and so may be much higher than current development contributions.

There may be significant benefits to developers in having their land designated as an Urban Development Zone. In deciding whether to lobby for inclusion in such a zone, landowners should carefully review the effects of designation and the wording of the Bill.

The Bill is intended for pre legislative scrutiny in the upcoming Oireachtas session.

For more information regarding these initatives, contact a member of our Real Estate team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

Share this: