Despite increasing business failures in sectors like hospitality and retail, the 2023 Courts Service Annual Report reveals that creditors remain surprisingly inactive in enforcing debt recovery. Even with a 15% rise in debt recovery claims, creditor enforcement is still lagging behind pre-pandemic levels. This article dives into the latest data, exploring why creditors are not leveraging their legal rights and what the trends could mean for businesses struggling to maintain cash flow. Our Debt Recovery team looks at the implications of these findings and why now may be the time to act on overdue debts.

There has been much media scrutiny over the past 12 months on the increased cost of doing business, and in many cases, getting paid, in Ireland. High-profile business closures, especially in the hospitality and retail sectors, have highlighted this issue. It is, therefore, worth looking at civil litigation and debt recovery in particular through that lens. In that context, the publication of the Courts Service Annual Report 2023 provides us with plenty of data to consider.

The only constant is change

In pre-COVID times when we analysed the Annual Reports of the Courts Service, we noted a steady rise in creditor activity year on year, especially at the level of the lower courts. The global pandemic and Government/business responses that followed ushered in a new era. Since then, the fallout from a period of intense business disruption has had a considerable bearing on creditor activity. Creditor enforcement activity during that period was sparse and the Courts Service’s latest 2023 Report indicates a continued decline.

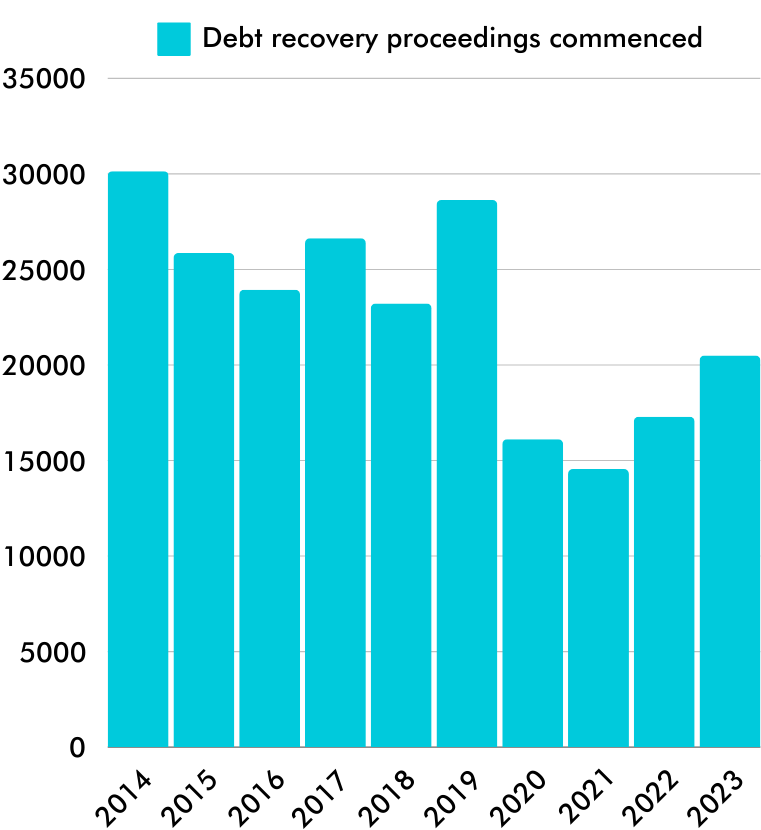

Debt recovery proceedings commenced

The 2023 Report noted there were almost 180,000 new civil litigation matters across all courts that year, up from just over 170,000 in 2022, and 140,000 in 2021. Undoubtedly, this points to a growing busyness in the system. However, 2023 saw the appointment of 24 additional judges to the Irish Courts, and the further implementation of the Courts Service Modernisation Programme.

In addition, the 2023 Report notes a 15% growth in the volume of debt recovery claims commenced in the Irish Courts. The vast majority of these claims are taken at District Court level, frequently by financial institutions or state bodies seeking to recover specified sums from customers. However, the 2023 figure remains well below the 2014 to 2019 equivalents.

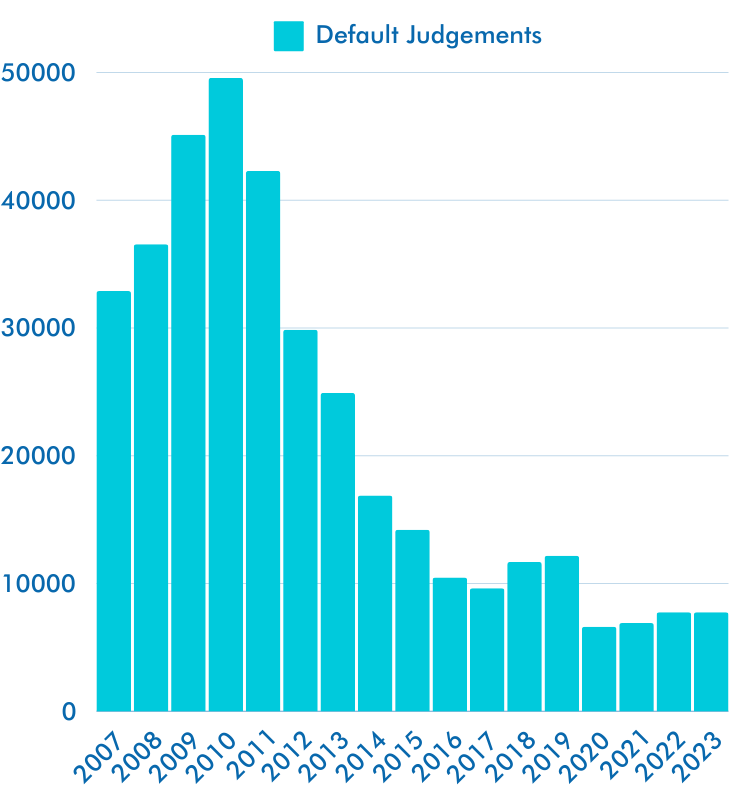

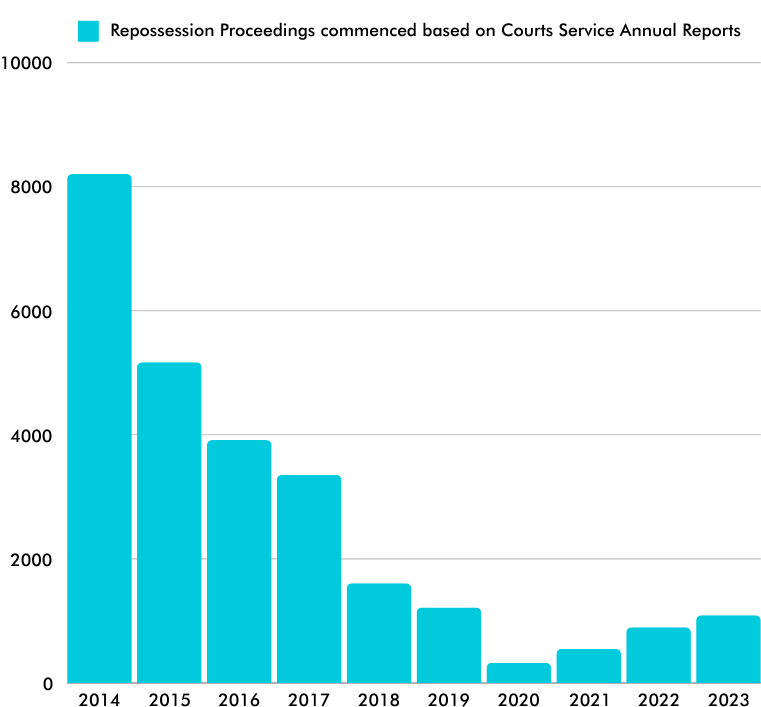

Default judgments and repossession proceedings

In our interrogation of the data, our Debt Recovery team has traditionally looked at the number of default judgments obtained by creditors as a barometer of economic prosperity, or distress. We note that default judgment numbers have been falling consistently over the past decade or more. Indeed, the 2023 figure for default judgments was almost identical to its 2022 equivalent, reflecting the absence of a surge in litigation and enforcement by creditors.

This observation is corroborated by figures in the 2023 Report for the usage of court enforcement remedies which also saw levels broadly equivalent to 2022. These include measures like publications of judgments, judgment mortgage applications and instalment order applications. Although there were rises recorded in the numbers for both corporate and personal insolvency cases, those year-on-year increases could not be characterised as dramatic. Traditional mortgage lenders in Ireland have continued to dispose of non-performing loans over the past few years. In some instances, this trend has been necessitated by a lender’s exit from the Irish banking market. As a result, we have observed similar trends in mortgage repossession activity during 2023. The Report shows a slight rise in the volume of new repossession proceedings that year – from 898 in 2022 to 1,091. In addition, there were 212 orders for repossession granted by the courts – very similar to the previous year.

Comment

We have previously commented that creditor litigation, enforcement activity and insolvency were all set to rise in the years following the lifting of restrictions imposed by the COVID-19 pandemic. The end of Revenue’s debt warehousing programme in May 2024 was also seen as being an event that may lead to an uptick. The pressure points caused by inflation and interest rate rises are felt more keenly by business creditors in some sectors than others.

That said, the 2023 Report does not suggest that creditors are using the legal system to enforce their positions in a significant way despite the undoubted delays many face in getting paid.

Efficiency of collections and unhindered cash flow is crucial for the viability of any business. The fact remains that creditors should always seek to leverage their legal rights, particularly in instances where they suspect that a debtor is capable of paying but is choosing not to.

For more information and expert advice, please contact a member of our Debt Recovery team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

Share this: