Navigating Ireland’s Corporate Sustainability Reporting Regulations

Key Impacts for Businesses

Our ESG team breaks down Ireland’s implementation of the Corporate Sustainability Reporting Directive (CSRD), highlighting unexpected complexities that broaden the scope and accelerate sustainability reporting obligations for many companies. Readers will gain valuable insights into how to prepare for these extensive requirements and understand the practical steps needed to ensure compliance under the new regulations.

The Corporate Sustainability Reporting Directive, or CSRD, is groundbreaking European Union legislation which is designed to improve access to high quality, reliable and comparable sustainability information from businesses across the EU and beyond. It establishes a harmonised EU-wide framework which will require many companies to make extensive annual disclosures on ESG matters.

Following an 18-month transposition period during which EU Member States were required to incorporate the CSRD into their national laws, the European Union (Corporate Sustainability Reporting) Regulations 2024 (the Regulations) came into force in Ireland on 6 July 2024. Minor amendments were also later made by the European Union (Corporate Sustainability Reporting) (No.2) Regulations 2024. The Regulations now integrate the sustainability reporting framework set out in the CSRD into Irish company law.

However, the Regulations have also given rise to a number of unexpected, and perhaps unintended, surprises. In particular, they apply sustainability reporting obligations to companies which, based on the CSRD, had been expecting to find themselves outside scope. They also extend the scope of sustainability reporting obligations and accelerate the commencement of those obligations for companies which, based on the CSRD, had been anticipating more limited reporting requirements and a longer lead-in time to prepare. The Regulations also unduly limit exemptions for group reporting.

Further legislation appears to be necessary to align the Irish position more closely with the CSRD. However, in the meantime, we look at the key points relating to the implementation of the CSRD in Ireland to date.

Applicable companies

Subject to limited exclusions[1], the new sustainability reporting framework applies to the following categories of Irish companies:

Large companies

A large company includes any company which, for the relevant financial year, fulfils two or more of the following requirements:

- Net turnover exceeding €50 million

- Balance sheet total exceeding €25 million

- Average number of employees exceeding 250

A large company also includes any holding company of a group which, for the relevant financial year, on a consolidated basis, fulfils two or more of those requirements.

However, from an Irish company law perspective, a large company also includes any company which, regardless of its size, cannot qualify as a micro company, a small company or a medium company. Crucially, this means that any Irish company with transferable securities listed on an EU-regulated market is a large company for the purposes of the Regulations.

Listed SMEs

As envisaged by the CSRD, the Irish legislative framework applies sustainability reporting obligations to small companies and medium companies, excluding micro companies, which have transferable securities admitted to trading on a regulated market of any Member State.

However, any Irish company which has transferable securities admitted to trading on a regulated market of any Member State is deemed to be a large company, regardless of its net turnover, balance sheet and employee headcount. Therefore, there are currently no Irish companies capable of falling within this category. It remains to be seen whether this will be addressed by way of further clarifying legislation.

Commencement of reporting obligations

Sustainability reporting obligations for in-scope Irish companies commence as follows:

Type of Company |

Reporting Obligations Apply |

Large companies which are public-interest entities[2] and which have an average number of employees exceeding 500 |

All financial years commencing on or after 1 January 2024 |

Other large companies |

All financial years commencing on or after 1 January 2025 |

- Small companies and medium companies, excluding micro companies, which have transferable securities admitted to trading on a regulated market of any Member State - Applicable companies being either small and non-complex institutions or captive insurance undertakings or captive reinsurance undertakings |

All financial years commencing on or after 1 January 2026, subject to an opt-out on a “comply or explain” basis until financial years commencing on or after 1 January 2028 |

As detailed, any Irish company which has transferable securities admitted to trading on a regulated market of any Member State is a large company. This has a significant impact on the obligations of any such company which, based on its net turnover, balance sheet and employee headcount, expected to be classified as an SME for sustainability reporting purposes. It means that its obligations will now commence sooner than had been expected and it cannot avail of the opt-out until 1 January 2028. It also means that it will be subject to full reporting obligations, rather than the more limited reporting requirements intended to apply to in-scope SMEs. Again, it remains to be seen whether this will be addressed by way of further clarifying legislation.

Reporting requirements

An in-scope company will be required to prepare a sustainability report setting out, amongst other things:

- Information necessary to understand the company’s impacts on sustainability matters, and

- Information necessary to understand how sustainability matters affect the company’s development, performance and position

That information must include information not only on the company’s own operations but also on the operations of its value chain. Transitional arrangements apply for the first three years in which more limited value chain reporting is permitted on a “comply or explain” basis if not all information is available.

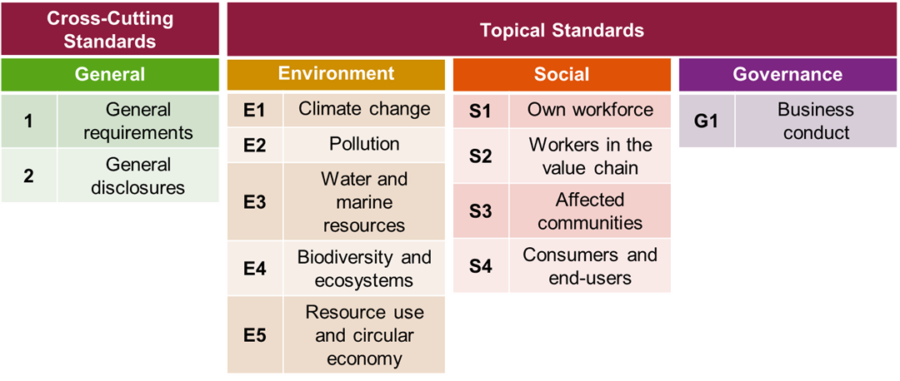

Sustainability information must be reported in accordance with the European Sustainability Reporting Standards (ESRS) adopted, or to be adopted, by the European Commission. To date, the only ESRS adopted are as follows:

Simplified ESRS for in-scope SMEs are awaited. Additional sector-specific ESRS and ESRS for third country undertakings are due to follow by June 2026.

While certain disclosure requirements set out in the ESRS are mandatory for all in-scope companies, the extent of an in-scope company’s reporting obligations will largely depend on the outcome of its “double materiality assessment”. This means the company will need to consider the relevance of each sustainability topic in the ESRS from two perspectives:

- Financial materiality: Relevance to or influence on the company’s own development, financial position, financial performance, cash flows, access to finance or cost of capital over the short, medium or long-term

- Impact materiality: Pertains to the company’s external impact on the environment and people material, whether positive or negative and whether actual or potential, over the short, medium or long-term

Consolidated sustainability reporting

An Irish in-scope company which is a holding company must carry out consolidated sustainability reporting for its group.

Certain exemptions from single-entity and group-level sustainability reporting apply. However, those exemptions are, most likely in error, more limited than envisaged by the CSRD.

Subject to certain conditions, an Irish in-scope company may be exempt from sustainability reporting obligations if it, and its subsidiaries, are included in a consolidated sustainability report of an Irish holding company. A similar exemption applies if an Irish in-scope company together with its subsidiaries are included in the consolidated sustainability report of a non-EU holding company. This is provided that the non-EU holding company reports in accordance with the ESRS or other standards which are determined by the European Commission to be equivalent. Unhelpfully, however, the Regulations omit an equivalent exemption for an Irish in-scope company which has an EU, but non-Irish, holding company. We expect this omission will need to be rectified.

The exemptions do not apply to certain public-interest entities with transferable securities admitted to trading on a regulated market of any Member State.

Third country reporting

The Regulations also contain provisions related to reporting by the following non-EU undertakings:

Non-EU undertakings with an Irish branch

An Irish branch is subject to the Regulations if:

- It generated net turnover of more than €40 million in the preceding financial year

- The non-EU company at its group level or, if not applicable, the individual level, generated a net turnover of more than €150 million in the EU for each of the preceding two consecutive financial years, and

- The third country undertaking is either not part of a group or is a subsidiary of another third country undertaking and it does not have an in-scope subsidiary

Any such Irish branch must deliver to the Companies Registration Office for the relevant financial year a sustainability report of the third country undertaking at its group level or, if not applicable, individual level. The sustainability report must be accompanied by the necessary assurance report.

Non-EU undertakings with an Irish in-scope subsidiary

Third country sustainability reporting obligations need to be considered in the case of an Irish subsidiary which is within the scope of the Regulations itself and has a non-EU parent company. If, at its group level, that parent company generated a net turnover of more than €150 million in the EU for each of the preceding two consecutive financial years, group level sustainability reporting will be required. Any such Irish subsidiary must annex to its annual return a sustainability report of the third country undertaking at its group level. The sustainability report must be accompanied by the necessary assurance report.

Reporting concerning third country undertakings applies for financial years commencing on or after 1 January 2028.

The sustainability report of a non-EU undertaking must be drawn up in accordance with ESRS for third country undertakings to be adopted by the European Commission or reporting standards determined to be equivalent. Those standards are not yet available.

Assurance of sustainability reporting

Any Irish company that is subject to sustainability reporting requirements must appoint one or more statutory auditors for each financial year to carry out the assurance of its sustainability reporting. Those statutory auditors may be different auditors to those appointed for the purpose of audit of financial information.

Assurance standards are to be adopted by the European Commission. In the meantime, national assurance standards may be adopted by the Irish Auditing and Accounting Supervisory Authority. Assurance will initially be on a “limited assurance” basis.

Format and publication of sustainability reports

Sustainability reporting by an in-scope Irish company must be contained in a clearly identifiable dedicated section of its directors' report and group directors' report, if applicable. Sustainability information must be reported in a prescribed electronic, digitally tagged format to ensure it is machine-readable and therefore more accessible.

The process for approval and publication of sustainability reporting follows the existing company law process on approval and publication of the directors' report and group directors' report. These reports must be annexed to the company’s annual return, along with

- Its financial statements

- The auditors’ report on the financial statements, and

- The auditors’ report on sustainability information

Those documents must be filed in the Companies Registration Office within 56 days of the company’s annual return date.

Enforcement

There is no separate penalty or enforcement regime governing sustainability reporting. Existing company law penalties and offences relating to failures to prepare a directors' report or group directors' report, or to file an annual return with all necessary documents annexed to it continue to apply.

Conclusion

The transposition of the CSRD in Ireland is a significant milestone which launches many Irish companies into a new era of corporate governance in which accountability and transparency regarding sustainability matters are no longer optional.

However, the Irish legislation introduced unexpected complexities. The expanded application and accelerated timelines for reporting obligations have created challenges and uncertainties, especially for companies which had reasonably understood that they would be outside scope. We will monitor developments closely and continue to keep our clients and contacts informed. In the meantime, it is of central importance that all in-scope companies begin or continue preparations for sustainability reporting. Reporting obligations are extensive so early engagement with the legislation, including the ESRS, and with stakeholders is vital to establish reliable systems for data collection and reporting.

Please get in touch with our ESG team to discuss how we can help your organisation in scoping and understanding its obligations under the Regulations.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

[1] Exclusions apply to alternative investment funds and UCITS (Undertakings for Collective Investment in Transferable Securities). The Central Bank of Ireland, post office giro institutions, the Strategic Banking Corporation of Ireland and credit unions and friendly societies are also excluded from scope.

[2] Public-interest entities are undertakings that:

(1) have transferable securities admitted to trading on a regulated market of any Member State,

(2) are credit institutions,

(3) are insurance undertakings, or

(4) are undertakings that are otherwise designated, by or under any other enactment, to be entities referred to in point (d) of Article 2(1) of Directive 2013/34/EU.

Share this: