Competition Law: Year in Review 2023

Most Notable Cases and Developments

CCPC Concludes Four Phase II Investigations

The CCPC closed four Phase II investigations (a fifth Phase II investigation remains ongoing). Two of these transactions were cleared subject to commitments (only one of which involved the issuance of an Assessment whereby the CCPC formally puts its preliminary competition concerns, and evidence to support these concerns, in writing to the parties). M/22/067 - Thorntons Recycling/Carducci Holdings (The City Bin Co.) was cleared subject to a structural commitment to divest the entire increment of domestic waste customers within the areas in which both parties are active. M/22/040 – Q-Park / Tazbell Services was cleared subject to various commitments, including Q Park agreeing to cease operation of one of its Dublin city centre car parks at the expiration of the existing contract (allowing another competitor to bid), the divestment of its Galway business (operating a car park) and a confidentiality commitment. The CCPC’s two other Phase II determinations were unconditional and notably did not involve an Assessment. Indeed, recent experience seems to confirm that, once the CCPC issues an Assessment, the likelihood of obtaining an unconditional clearance decision is low.

CCPC Increasingly Requires Structural And Hybrid Commitments

Horizontal competition concerns led the CCPC to clear two Phase I transactions subject to legally binding commitments. In M/22/049 - Uniphar/LXV Remedies (Sam McCauley), the deal was cleared subject to Uniphar divesting three pharmacies in areas in which both parties are active. M/23/010 - BWG/Tuffy Wholesale was cleared subject to a hybrid commitment by BWG to divest certain of the target’s shareholdings, as well as a firewall commitment to prevent the exchange of competitively sensitive information. Considered together with the Phase II commitments outlined above, it seems the CCPC is increasingly insisting on structural or hybrid commitments and less inclined to accept purely behavioural commitments.

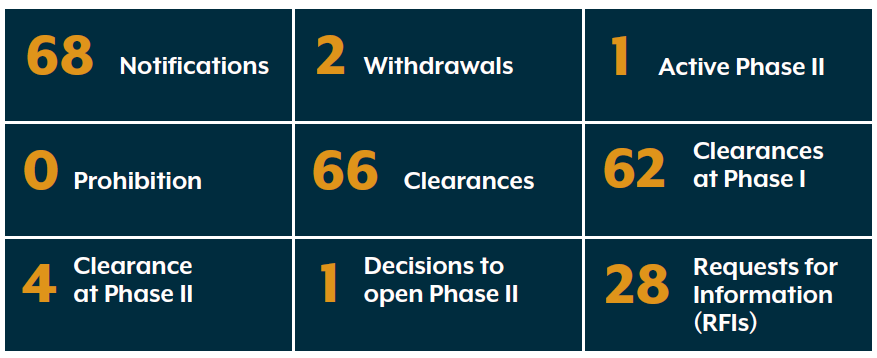

CCPC Frequently Issuing Formal RFIs

The CCPC frequently used its power to stop the clock during reviews, issuing 28 formal RFIs. This represents 38% of all mergers cleared by the CCPC during 2023 (3 cases in which RFIs were issued remain on-going in 2024). This is indicative of the CCPC’s desire for more detailed information and perhaps also reinforces its increased reliance on internal documents (which are typically requested in RFIs). It’s also worth noting that two transactions, which were notified to the CCPC under the Simplified Procedure, were converted to the Standard Procedure through the issuance of an RFI.

CCPC Gets Significant New Enforcement Powers

The Competition (Amendment) Act 2022 (Act) came into force on 27 September 2023, making substantial changes to Ireland’s competition laws.

For the first time, the CCPC has the power, subject to court approval, to impose administrative financial sanctions of up to €10 million or 10% of total worldwide turnover on parties that infringe the competition laws.

This power is accompanied by the introduction of a new Administrative Leniency Policy (ALP), which enables the CCPC to grant immunity from, or a reduction of, administrative sanctions where the parties disclose their participation in the infringement and cooperate with the CCPC. The ALP operates alongside the existing Cartel Immunity Programme (CIP), creating the possibility for parties to a cartel infringement to make parallel applications for immunity under both the ALP and the CIP. Notably, the CCPC has also extended the ALP to cover resale price maintenance (see our earlier RPM Insight). We expect to see a significant uptick in leniency applications, including in relation to RPM in 2024 and beyond.

The Act creates a new specific offence of bid-rigging, which is expected to be an enforcement priority for the CCPC in 2024. Our earlier bid-rigging Insight explores the potential implications for public procurement.

The Act also gives the CCPC significant new merger control powers, including the ability to ‘call in’ below threshold mergers, issue requirements for information to third parties, impose interim measures and to unwind certain transactions. These changes, and more, are explored in greater detail in our recent merger control Insight and our ‘Competition (Amendment) Act 2022’ Insight.

CCPC Updates Policies And Procedures

This year, the CCPC updated, and in some cases introduced, a number of guidelines and procedures, primarily to take account of the Competition (Amendment) Act 2022, including the following:

- Merger Notification Form, which now also requires more detailed information from notifying parties.

- Mergers and Acquisition Procedures, which includes changes made in light of the CCPC’s more recent experience.

- Guidance Note on Pre-Notification Merger Discussions, which further highlights the CCPC’s views on the importance of pre-notification discussions and the information parties should provide prior to such discussions.

- A series of policies, guidelines and procedures, including:

– CCPC & ComReg Joint Policy on Leniency Applications in the electronic communications sector

– Guidance note on the interaction between the CIP and the ALP

– Guidance note on the CCPC’s choice of enforcement regime for breaches of competition law

– Guidelines on the determination of administrative financial sanctions and periodic penalty payments, and

– Guidance on access to the file procedures.

CCPC Resumes Dawn Raids

In December 2023, the CCPC conducted searches of businesses as part of an on-going criminal investigation into potential breaches of competition law in the publicly funded transport sector. These appear to be the only dawn raids conducted by the CCPC in 2023 but may be indicative of further dawn raids to come in 2024 as the CCPC seeks to put its expanded powers into action.

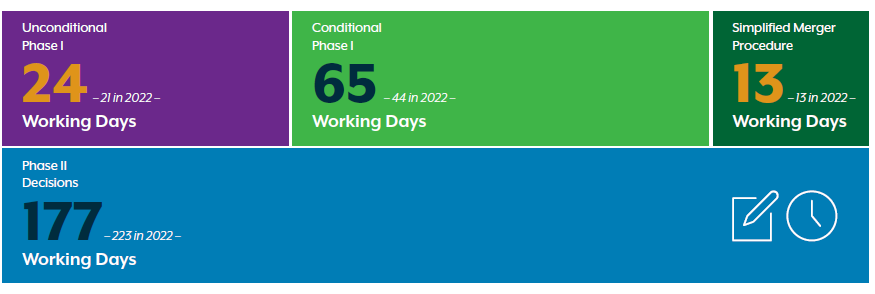

Another Busy Year for the CCPC’s Mergers Division

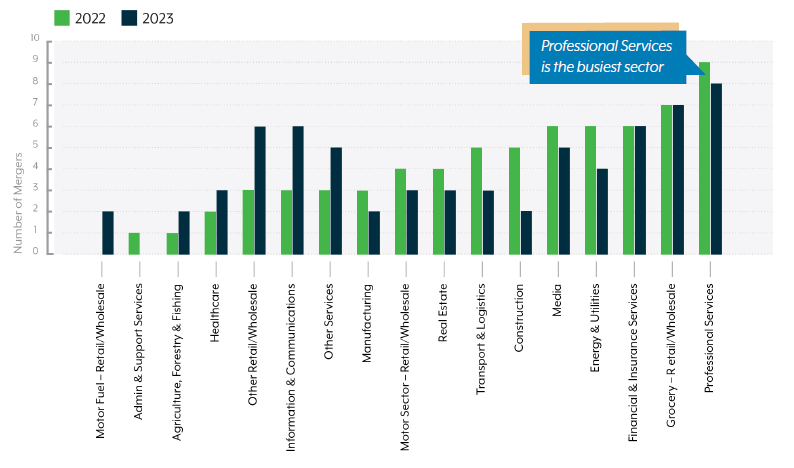

Number of Mergers by Sector 2022 – 2023

Looking Ahead To 2024

Introduction Of Mandatory FDI Screening In Ireland

It is anticipated that the Screening of Third Country Transactions Act (the STCT Act) will be implemented by Ministerial Order in Q2 2024.The Act will introduce a mandatory and suspensory notification regime which applies to transactions which meet certain criteria. Our Insight on ‘The Screening of Third Country Transactions Act’ outlines the key features of the STCT Act. For further information, see the Irish chapter we contributed to the International Comparative Legal Guide on Foreign Direct Investment Regimes 2024.

As there is currently no investment screening regime in place in Ireland, it is expected that the STCT Act will have a significant impact on the timeline for transactions involving foreign investment into Ireland. The STCT Act sets a low financial threshold for mandatory screening. In addition, the categories of sensitive and strategic activities are defined broadly, with the STCT Act referring to the matters set out in Article 4(a) to (e) of the EU Screening Regulation 2019/452. This means that the STCT Act has the potential to cast a very wide net.

The STCT Act also gives the Minister for Enterprise, Trade and Employment retroactive powers to ‘call in’ transactions not required to be notified where the Minister has reasonable grounds for believing the transaction is likely to affect the security or public order of the State. The Minister cannot review any transaction that completed more than 15 months before the commencement of the STCT Act.

CCPC To Update Guidelines For Merger Analysis In 2024

The CCPC recently announced its plans to update the Guidelines for Merger Analysis in 2024. The current Guidelines were published in 2013 and have not been updated since then. As part of the process, it is expected that the CCPC will open a public consultation to engage with stakeholders and other interested parties.

Share this: