Assessing Built Environment Workers' Status for Tax Purposes

Revenue’s new guidelines on employment status for tax purposes based on the Karshan decision signal changes, which are relevant to the built environment sector. More contractors may now be classified as employees for tax purposes, impacting PAYE obligations. Learn how to navigate the five-step framework and mitigate risks. Read the full article for key insights and compliance strategies.

The Revenue Commissioners (Revenue) recently published guidelines on determining employment status for tax purposes (the Guidelines). The Guidelines will be of interest to businesses in the built environment sector which engage independent contractors.

It is clear from the Guidelines that Revenue expect that there will be an increase in the number of workers that will be determined to be employees rather than independent contractors for tax purposes. This is an important issue for businesses because, where a worker is an employee for tax purposes, the employer must apply the pay as you earn (PAYE) withholding system on payments and benefits provided to that worker.

Five-step framework

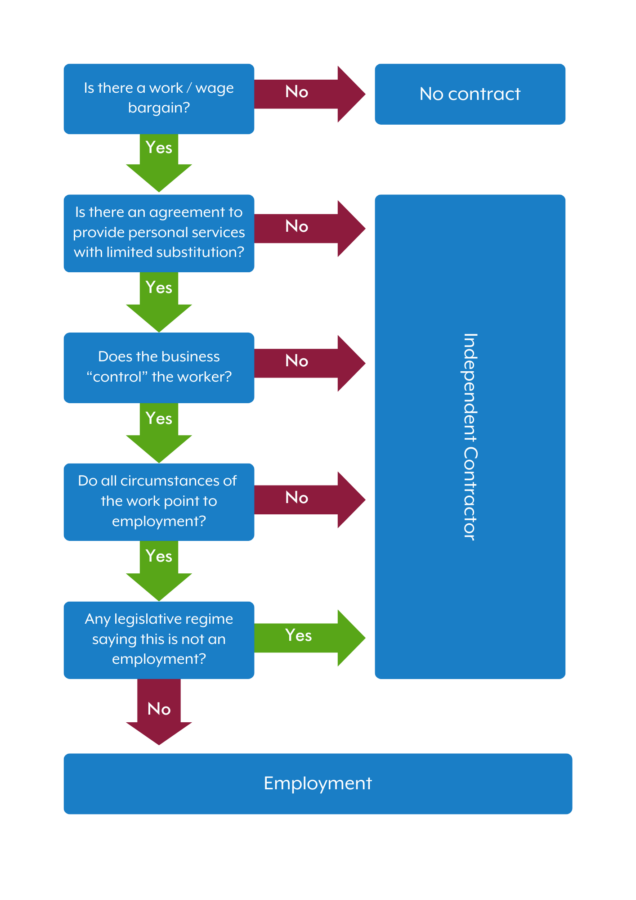

The Guidelines were issued in light of a landmark decision of the Irish Supreme Court in The Revenue Commissioners v Karshan (Midlands) Ltd. t/a Domino’s Pizza. In that decision, it was held that delivery drivers of Domino’s Pizza should be treated as employees and not independent contractors for tax purposes. The Guidelines set out a five-step “decision-making framework”. This framework is derived from the Karshan case to assist employers in identifying whether or not a worker is an employee.

Some important points for the built environment sector

Part-time and casual workers

Revenue note in their Guidelines that there has been a perception that when workers were engaged on a part-time or casual basis, including specifically for one off shifts, they were not employees as there was no continuous employment obligation. However, the arrangements with these workers should be analysed using the five-step framework in the same way as any other workers.

All of the circumstances of the work

Step 4 involves an examination of the terms of the contract interpreted in the light of all of the circumstances of the work to establish if the working arrangement is consistent with an employment or whether the individual is self-employed. The guidelines confirm that, while a detailed written agreement may carry significant weight, efforts to describe a relationship in a particular way which differs from the day-to-day reality may be challenged. It is also confirmed that including phrases such as “as a self-employed contractor you will be responsible for your own tax” are not sufficient to ensure that a worker will not be treated as an employee for tax purposes.

The Guidelines note that there are no “static characteristics” of an employment arrangement, but some specific examples relevant to the built environment sector are provided.

Scenarios where a worker is likely to be determined to be an employee for tax purposes, following the application of the framework, include:

- Construction workers engaged on a full-time, or near full-time, basis by a single entity or a group of connected entities and have no autonomy as to what work they do and when they work.

- An unskilled worker operating as, for example, a casual labourer paid an hourly rate, taking direction from the site foreman.

- A skilled worker, eg, electrician, plasterer, roofer, who works alone, ie, does not employ a team to work for him or her, uses material supplied by the business and is told what, where and when to do work.

- An individual fitting windows for one company or a group of connected entities, on a continuous basis, using equipment supplied by the business, and travelling in or driving a company vehicle.

Scenarios where a worker is properly treated as self-employed for tax purposes, following the application of the framework, include:

- An electrician who has his or her own firm with a team of workers, is engaged to wire a number of houses for a fixed fee, is free to send anyone he or she wishes to undertake the work and can profit if it is done more efficiently, ie, in less time.

- Any worker who provides their service through a corporate, ie, they are not engaged directly as an individual by the business (construction company), rather the business engages another company to provide a service, which is undertaken by the worker. In this case, the worker may be an employee of the service company.

Payments made to self-employed workers in the construction industry may be subject to Relevant Contracts Tax (RCT) which should, if applicable, be operated by the business paying the worker.

Personal/managed services companies

It is common in the construction sector for workers to be employed through personal/managed services companies. Helpfully, Revenue have confirmed that there is no change in the tax position for businesses who engage such companies to conduct work on their behalf. Revenue will generally not look behind corporate structures. However, businesses employing contractors through personal/managed services companies should be aware that it is important that the invoicing and payment arrangements are correctly administered by the company so that its operations are in line with the contractual arrangements. Also, Irish PAYE must be applied to payments for services of a director of an Irish incorporated company even if these are provided through a company.

The personal/managed services company will have a PAYE withholding requirement for payments to its directors and employees and whether workers are employees for tax purposes should be determined in line with the tests outlined previously. A secondary liability to Irish PAYE may arise for the end-user businesses where an employee of a non-Irish company performs duties in Ireland. This means that the end-user business can be liable for the PAYE which should have been withheld by the personal/managed services company, so it is important that businesses are appropriately protected from this risk.

Agencies

It is also common in the built environment sector for workers to be employed through agencies. The Guidelines confirm that Revenue do not regard the taxation of workers employed through agencies any differently to the taxation of workers employed by any other means. For agency workers, the person who is contractually obliged to make the payment to an employee is the employer for the purpose of collecting income tax, USC and PRSI through the PAYE system.

Employment law implications

While the Karshan decision and Guidelines concern employment status for tax purposes, they may also be relevant in the context of determining employment status for employment law purposes. This is due to overlap in tests used by Revenue and bodies adjudicating on employment rights, such as the Workplace Relations Commission, Labour Court and civil courts, to determine employment status. Where an employee is misclassified as an independent contractor, this gives rise to significant liabilities under employment law, in addition to tax and social insurance liabilities.

Conclusion

Revenue indicate in the Guidelines that they expect businesses to review arrangements and apply the five-step framework to determine if a worker should be treated as an employee. Evidence should be retained of the analysis done to apply the framework when a worker is engaged and at regular intervals thereafter. This is especially important where a contractor’s role may develop over time. Businesses in the built environment sector should take action to ensure that are prepared in advance of any Revenue compliance intervention as it is clear that this is an area of focus for Revenue.

People also ask

What was the ‘Karshan’ case about? |

The ‘Karshan’ case was about whether delivery drivers of Domino’s Pizza should be treated as employees or independent contractors for tax purposes. |

Can part-time/casual workers be regarded as employees for tax purposes? |

Yes, but the determination of the tax treatment of such workers should be made following application of the five-step framework. |

Do the Revenue Guidelines only apply to those in the service industry? |

No, the Revenue Guidelines apply to all sectors and industries. |

For more information and expert advice on all relevant taxation matters impacting your business, contact a member of our Tax team.

The content of this article is provided for information purposes only and does not constitute legal or other advice.

Share this: