The European Union (Corporate Sustainability Reporting) Regulations 2024

What are the European Union (Corporate Sustainability Reporting) Regulations 2024?

The European Union (Corporate Sustainability Reporting) Regulations 2024 transpose the EU’s Corporate Sustainability Reporting Directive (CSRD) into Irish national law.

The CSRD is one of a number of measures introduced as part of the European Green Deal - the plan for delivery of climate-neutrality in the European Union by 2050. It introduced a new harmonised EU-wide framework which will require many companies across the EU and beyond to make extensive annual disclosures on ESG matters. Ultimately, the CSRD is designed to improve access to high quality, reliable and comparable sustainability information. The European Union (Corporate Sustainability Reporting) Regulations 2024 now integrate the CSRD framework into Irish company law.

What is the scope of the European Union (Corporate Sustainability Reporting) Regulations 2024?

Analysis as to the application of the European Union (Corporate Sustainability Reporting) Regulations 2024 can be complex. The complexity is increased by some unanticipated deviations in the Irish legislation from the CSRD’s scope. However, broadly speaking, the European Union (Corporate Sustainability Reporting) Regulations 2024 apply to the following categories of companies, subject to some exceptions:

Category |

Description |

Commencement of Reporting Obligations |

Large “public interest” undertakings |

Large undertakings, as described below, which have securities listed on an EU-regulated market and which have an average number of employees exceeding 500 |

Financial year starting on or after 1 January 2024 |

Other large undertakings |

EU undertakings which exceed the limits of at least two of the following criteria:

OR which are otherwise classified as large companies for the purposes of the Companies Act 2014 |

Financial year starting on or after 1 January 2025 |

Listed small and medium-sized enterprises and applicable companies which are either small and non-complex institutions or captive insurance undertakings or captive reinsurance undertakings |

All small and medium-sized companies with securities listed on an EU-regulated market, excluding “micro-undertakings” [1] |

Financial year starting on or after 1 January 2026, with an opt-out right for an additional 2 years |

Non-EU undertakings |

Third country undertakings generating an annual net turnover of €150 million in the EU at a consolidated level and with:

|

Financial year starting on or after 1 January 2028 |

What are the key features of the European Union (Corporate Sustainability Reporting) Regulations 2024?

1. European Sustainability Reporting Standards

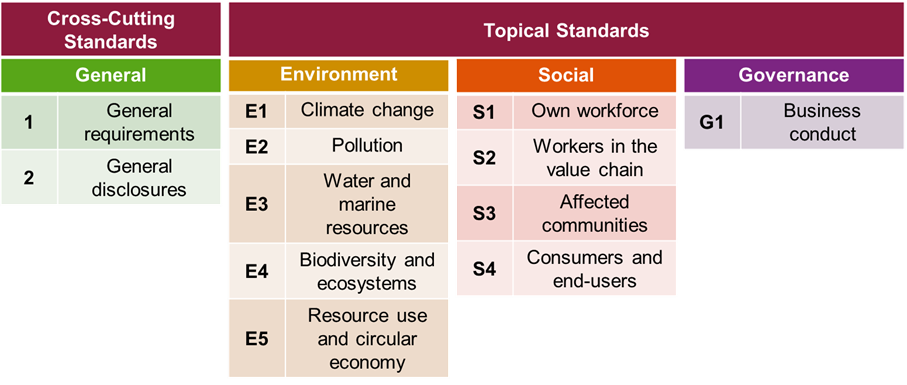

Companies within the scope of the European Union (Corporate Sustainability Reporting) Regulations 2024 will be required to prepare a sustainability report for each financial year. A new set of common reporting standards known as the European Sustainability Reporting Standards (ESRS) specify, in prescriptive detail, the information required to be contained in that sustainability report. To date, 12 separate ESRS have been adopted by the European Commission, with additional standards to follow in due course.

Those 12 ESRS include general disclosure requirements and specific disclosure requirements on environment, social and governance topics as follows:

Each ESRS contains a large number of disclosure requirements and individual data points. The highly-prescriptive nature of the ESRS aims to ensure that the type of sustainability information which is reported is consistent and relevant and that this information is comparable across and within market sectors.

The ESRS will, in many cases, require in-scope companies to report on not only their own operations but on the operations of their value chains, including products and services, business relationships and supply chains.

Simplified ESRS for in-scope SMEs are awaited. Additional sector-specific ESRS and ESRS for third country undertakings are due to follow by June 2026.

2. Double materiality

General disclosure requirements under the cross-cutting ESRS are mandatory for all in-scope companies. However, any requirement to make disclosures under the topical ESRS will depend on the outcome of a company’s double materiality analysis.

“Double materiality” requires companies to consider the materiality of each topic from two perspectives:

- Financial materiality: Does the topic trigger a material financial effect on the undertaking by generating risks or opportunities that have or could reasonably be expected to have a material influence on its development, financial position, financial performance, cash flow, access to finance or cost of capital in the short, medium or long-term?

- Impact materiality: Does the topic pertain to the undertaking’s potential impacts, whether positive or negative, on people or the environment over the short, medium or long-term?

Any topic which is material in either respect, or both respects, will need to be considered in more detail from a reporting perspective. Further double materiality analysis may be required to identify the applicable disclosure requirements and data points within any such topic.

3. Consolidated reporting

The European Union (Corporate Sustainability Reporting) Regulations 2024 include a regime for consolidated sustainability reporting for corporate groups.

Subject to certain conditions, an Irish in-scope company may be exempt from sustainability reporting obligations if it and its subsidiaries, if applicable, are included in the consolidated sustainability report of a holding company. Exemptions for consolidated reporting need to be very carefully considered and specific legal advice should be taken.

4. Reporting frequency and format

Sustainability reporting by an in-scope Irish company must be contained in a clearly identifiable dedicated section of its annual director’s report, and group directors’ report, if applicable. Sustainability information must be reported in a prescribed electronic, digitally tagged format to ensure it is machine-readable and therefore more accessible.

The process for approval and publication of sustainability reporting follows the existing company law process on approval and publication of the director’s report, and group directors’ report, if applicable. The directors’ report, and group directors’ report, if applicable, must be annexed to the company’s annual return, along with its financial statements, the auditors’ report on the financial statements and the auditors’ report on sustainability information. Those documents must be filed in the Companies Registration Office within 56 days of the company’s annual return date.

5. Independent assurance

Any Irish company that is subject to sustainability reporting requirements must appoint one or more statutory auditors for each financial year for the purpose of carrying out the assurance of its sustainability reporting. Those statutory auditors may be different auditors to those appointed for the purpose of audit of financial information.

6. Enforcement

There is no separate penalty or enforcement regime concerning sustainability reporting. Existing company law penalties and offences for any failure to prepare a directors’ report, or group directors’ report, if applicable, or failure to file an annual return with all necessary documents, including the directors’ report, or group directors’ report, if applicable, annexed to it continue to apply.

When will the European Union (Corporate Sustainability Reporting) Regulations 2024 come into force?

The European Union (Corporate Sustainability Reporting) Regulations 2024 came into force on 6 July 2024.

Impact of the European Union (Corporate Sustainability Reporting) Regulations 2024

The impact of the new framework, and the challenge ahead from a compliance perspective, should not be underestimated by companies within its scope. This is particularly the case for in-scope companies which, to date, have no existing sustainability reporting practices or have reporting practices which are still relatively immature.

Irish companies need to ensure, sooner rather than later, that they know

- Whether they, or any companies within their groups, are subject to sustainability reporting requirements and

- If so, when their reporting obligations commence.

They will also need to identify their precise disclosure requirements in line with the double materiality principles. They will need to ensure that they have robust systems and practices in place to collect all relevant data in good time before their first report is due, including any information required from relevant value chain partners.

We are working with many of our clients to assist them in identifying their obligations under the European Union (Corporate Sustainability Reporting) Regulations 2024 and developing a roadmap towards compliance. Please contact a member of our Corporate Governance team to discuss how we can help you to prepare.

The content of this page is provided for information purposes only and does not constitute legal or other advice.

________________________________________

[1] Micro-undertakings are undertakings which do not exceed the limits of at least two of the following criteria:

- Balance sheet total: €450,000

- Net turnover: €900,000

- Average number of employees: 10